U.S. Equity Markets Ascend, Economy not so Much

Written by Anirban Bassu, Sage Policy Group

Asset Prices Rise Even as Economic Growth Remains Lackluster

In 2015, the U.S. economy expanded 2.4 percent. That was precisely the same rate of growth achieved in 2014. The U.S. economy continues to fall short of rates of growth to which we had become accustomed. During the 25 years that preceded the Great Recession, U.S. economic growth averaged 3.25 percent. The last time the U.S. economy expanded more than 3 percent during a single calendar year was 2005.

Virtually all of the growth that has taken place in recent months can be attributed to expanding consumer spending. Though personal consumption has not been surging, it has expanded enough to keep economic growth in positive territory. Consumer outlays expanded just 0.1 percent in February, the same amount as the two preceding months. Soft spending growth working in combination with faster income growth has conspired to produce a savings rate of 5.4 percent. The implication is that the consumer has the wherewithal to spend more during the months ahead.

Government spending has neither meaningfully added to nor subtracted from growth in recent periods. Exports, however, have been sagging due to a still sluggish global economy and a (until recently) stronger dollar. Though the calendar year has barely achieved adolescence, the International Monetary Fund has already downgraded its expectations for global growth in 2016 — twice.

Business investment has represented another drag on growth, with corporate profitability slipping. According to a report released by FactSet, a multinational financial and data software firm, analysts expect S&P 500 companies to collectively report an 8.5 percent decline in earnings for the first quarter of 2016 compared to the same period one year ago. If these expectations are realized, it will be the fourth consecutive quarter of U.S. corporate profit declines. Frequently, widespread declines in corporate profits are a prelude to recession.

Despite the ongoing malaise in U.S. corporate profits, few economists forecast recession in the near-term. In fact, a number of leading indicators have become more upbeat of late, including the Institute for Supply Management’s manufacturing PMI index, now back above 50 for the first time since last summer. Steady employment gains also suggest that the economic recovery, which has now completed 82 months, is not yet ready to end its voyage.

For several years, there has been an ongoing narrative suggesting that the BRIC nations (Brazil, Russia, India and China) would supplant the U.S. as the leading engine of global economic growth. That has happened to a degree, but not to the extent anticipated, in large measure because China is growing at its slowest pace in two decades, Russia remains in recession, and Brazil is in an even more precarious position.

Other emerging markets like Turkey and South Africa are also failing to take flight. A handful of emerging nations, however, continue to perform reasonably well along the dimension of economic growth, including India and Indonesia.

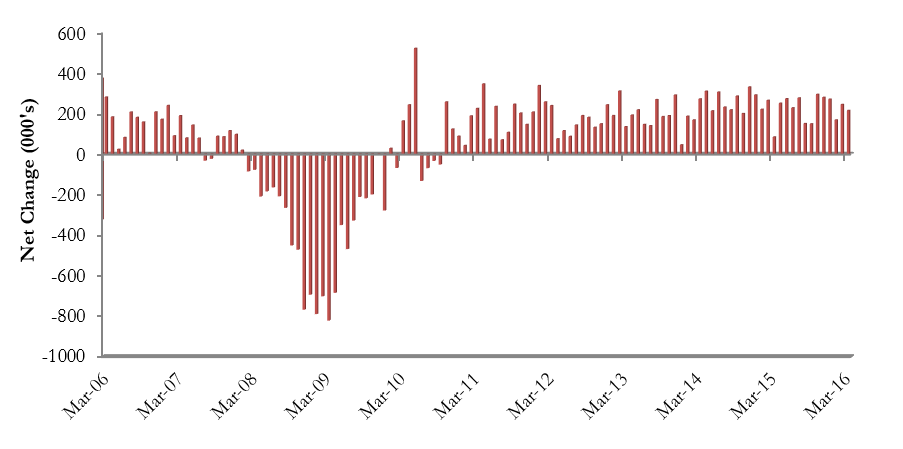

The most upbeat news regarding economic performance continues to emerge from the labor market. The U.S. added more than 200,000 net new nonfarm positions in March and has added approximately 2.8 million jobs over the past year according to data made available by the U.S. Bureau of Labor Statistics. In many industries, including construction and trucking, growing labor shortages are becoming more apparent. Rising minimum wages are also helping to push wages higher. For now, that means America’s consumer-led recovery is likely to remain in place.

What that means for equity markets is less obvious. The combination of slow economic growth and rapid employment growth implies weak productivity growth. That in turn suggests weak profit growth.

Add in a weak global economy, a strong likelihood of rising interest rates, and the possibility of an even stronger dollar and one has a recipe for soft profit growth going forward. The recent run-up in stock prices appears largely attributable to a recent weakening in the dollar, rising oil prices (which are generally correlated with equity prices), and dovish sentiment from the Federal Reserve indicating few additional short-term rate hikes this year. If rising wages and gasoline prices generate more inflation than anticipated, the Federal Reserve may need to alter its rhetoric and its policymaking. At a minimum, this could help produce significant volatility in the nation’s equity markets.

Lowe Wealth Advisors is an SEC registered investment adviser that maintains a principal place of business in the State of Maryland. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about the registration status and business operations of Lowe Wealth Advisors, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov.

This commentary is intended for the dissemination of general information regarding market conditions to Lowe Wealth Advisors clients. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results, and there is no guarantee that the views and opinions expressed in this report will come to pass. While any general market information and statistical data contained herein are based on sources believed to be reliable, we do not represent that it is accurate and should not be relied on as such or be the basis for an investment decision. Any opinions expressed are current only as of the time made and are subject to change without notice. This is not a recommendation to invest in commodities or any investment strategy. Commodities are historically volatile and not appropriate for every investor.