New Economic Drivers are Required

It’s all systems go for the U.S. economy. Well, nearly all systems go. Job growth recently has been superb, with the nation adding nearly three million jobs last year. Job quality has improved with construction, manufacturing and financial services each chipping in a considerable number of net new jobs. Gas prices have plummeted, giving consumers even more spending power. Interest rates have fallen, inducing more borrowing, investing and spending.

True, with oil prices falling, economic growth in Texas, North Dakota and Oklahoma could slow. For the most part, slumping petroleum prices are good news. The decline in oil prices is partially attributable to disappointing economic news emerging from Europe, China, Russia, Brazil and a handful of other key markets, but much of that is due to perverse supply dynamics. When prices fall, one expects quantity supplied to decline. Because certain nations are dependent upon total oil revenues, the response in Russia, Iran and Venezuela has been to boost oil production to maintain revenues to the extent possible. As prices have fallen, the urgency to produce has intensified, resulting in oil prices that recently fell below $50/barrel.

Most Americans and American businesses benefit from lower oil prices, and this represents a net positive for the U.S. economy even though equity market investors have acquired some jitters over the issue recently. Some of this is logical. A stronger U.S. dollar has helped suppress oil prices and that helps consumers, but it also hurts companies that depend upon exports. A stronger dollar can also induce more consumption of imports and makes it more likely that tourists will travel abroad rather than stay home.

Despite all of these complications, the national economy continues to see a robust growth. According to the BEA’s final estimate, third quarter GDP advanced at a five percent rate on an annualized basis. This is the strongest growth in 11 years and a significant leap from the initial estimate of 3.5 percent growth published in October. The upward revision was primarily the result of stronger contributions from personal consumption, nonresidential fixed investment and private inventory investment. Economists are optimistic that above-trend growth was sustained through the fourth quarter, with the consensus fourth quarter estimate for annualized growth standing at 3.2 percent as of this writing.

The combination of a stable economy, ultra-low interest rates and the relatively unattractive investment prospects in much of the balance of the world has produced surging stock prices. The Dow Jones Industrial Average reached above 18,000 for the first time on December 23, ending the year with 7.5 percent growth. Other U.S. domestic indices finished the year with two-digit growth rates: the S&P 500 with 11.4 percent and Nasdaq Composite with 13.4 percent growth. Despite the remaining concerns regarding the end of QE3, the spread of ISIL and the effects of Ebola, share prices quickly reflated after a near-correction in major financial exchanges.

Perhaps the most upbeat aspect of recent economic performance takes the form of labor market healing. The Bureau of Labor Statistics reported that the nation added 252,000 jobs in December. Over the past year, the nation has added 2.9 million jobs, the strongest year-over-year growth since June 2000. Of that total, nearly a quarter (732,000) was in professional and business service sectors. The list of other rapidly growing employment sectors includes distribution (e.g. retail and wholesale trade), health services, and leisure and hospitality.

The unemployment rate continues to fall. In December, the rate dropped by two-tenths of a percentage point to 5.6 percent, the lowest rate since June 2008 when the nation was just six months into the recession and on the verge of the global financial crisis. As has been the case during much of the current economic expansion, the decline in unemployment was partially attributable to reduced labor force participation. According to the most recent employment report, 273,000 individuals left the job market in December. During the year, however, the nation welcomed more than 1,000,000 net new workers to its workforce. The labor market participation rate continues to hover around a 35-year low of 62.7 percent. Much of that is due to accelerating retirement attributable both to aging and surging stock prices, which allow more people to retire comfortably.

Maryland

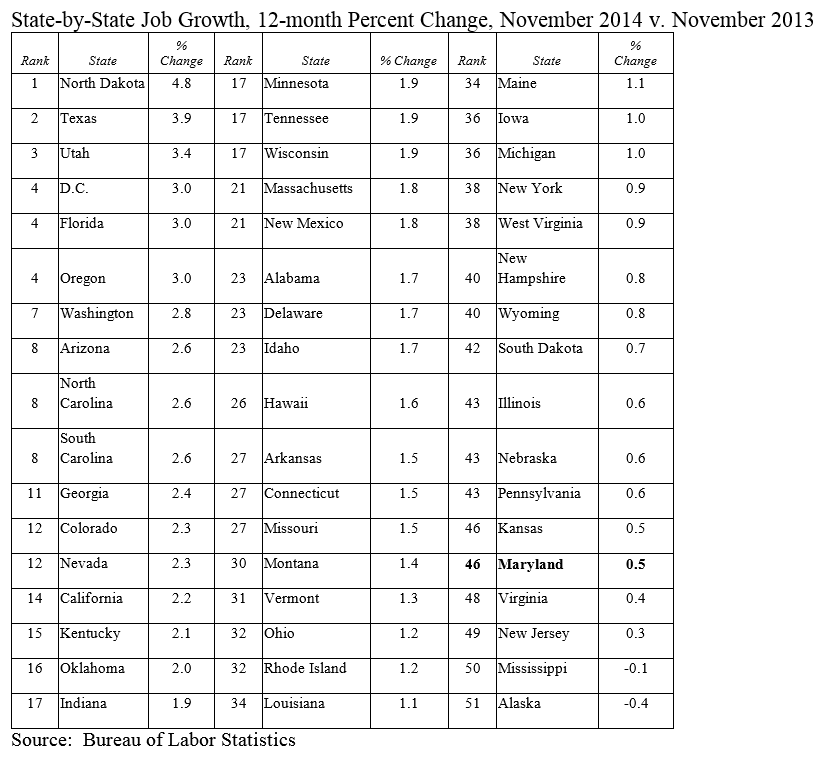

Maryland’s economic environment has become substantially more challenging relative to the other 49 states. The Free State ranked 45th out of 50 states in terms of job growth over the past calendar year for which data exist (November 2013 to November 2014). It ranked 46th if one includes the District of Columbia.

True, the state’s unemployment rate fell from 6.4 percent to 5.6 percent between August 2014 and November 2014, but that was not primarily a function of employment growth. A more concerning aspect of the state’s labor dynamics is the fact that the labor force has been shrinking for the past six months.

Maryland’s economy has been weakening as the national economy has been gaining momentum. Civilian technology, energy and industrial production segments have become active, translating into surging natural gas production, rising factory output, and initial public offerings at companies like Facebook and Twitter. For the most part, Maryland has not been a key factor in these types of growing economic activities.

Looking Ahead

Economic conditions across the nation are likely to improve as 2015 begins. According to the Federal Reserve Bank of Richmond’s Maryland Business Survey, the general business activity index registered a reading of 26 in September, advancing from 16 the prior month. While the expectations index, which reflects how respondents view economic activity over the next six months, dropped to 28 from 45, it remains positive, which indicates that economic circumstances are set to improve. Thirty-seven percent of respondents indicate a positive view of near-term economic prospects while only nine percent expect business conditions to deteriorate.

All data provided from the Sage Policy Group. Anirban Basu’s views and opinions are not necessarily those of Lowe Wealth Advisors and are not predictive of future outcomes and potential results. Lowe Wealth Advisors is an SEC registered investment adviser that maintains a principal place of business in the State of Maryland. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about the registration status and business operations of Lowe Wealth Advisors, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov.

This commentary is intended for the dissemination of general information regarding market conditions to Lowe Wealth Advisors clients. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results, and there is no guarantee that the views and opinions expressed in this report will come to pass. While any general market information and statistical data contained herein are based on sources believed to be reliable, we do not represent that it is accurate and should not be relied on as such or be the basis for an investment decision. Any opinions expressed are current only as of the time made and are subject to change without notice.