Pandemic

April 13, 2020

The first quarter of 2020 witnessed some of the most dramatic events in recent history. Most importantly, our thoughts are with those that have been impacted by Coronavirus and the displacements in its wake. Society will persevere once again, but the pieces won’t all neatly fall back into place for many. Some aspects of how people interact and how economies function will likely experience permanent change as a result.

Global financial markets registered historic declines in the first quarter as the Coronavirus epidemic in China became a global pandemic, and in doing so froze swaths of the economy. The S&P500 was down 20% as of the end of March, though the decline was larger measured from highs hit in only February. Few assets other than gold and U.S. Treasuries avoided the frantic selling pressure as the pain was felt across global financial markets. Even assets which are typically more shielded from big prices swings, among these high-grade corporate bonds, also saw substantial declines as the fast-changing world prompted a sell now, ask questions later response.

The market moves became more severe through March as the response enacted by government leaders to the fast-spreading virus became increasingly extreme. Never before has the modern world experienced such a comprehensive and immediate freeze of activity as schools were canceled, travel restricted or banned, businesses closed, and millions of citizens directed to shelter-in-place. According to a study by Moody’s Analytics, by the end of March, at least a quarter of U.S. economic activity was idled by the restrictions and similar controls were in place throughout most of the developed world. While economies can be naturally resilient to a wide variety of shocks, the extent and speed of this economic shutdown few had ever contemplated.

Shutting the economy down means stopping the flow of money. The action trickles down fast and impacts almost every facet of the economy as almost all functions are dependent on the activity of something else. When businesses are closed, people don’t get paid, rents can’t be met, expenses can’t be covered, and so on. The energy sector was most impacted as the fall in consumption came at the same time the Saudis announced intentions to pump even more oil in an effort to take global market share. The dual-threat caused oil prices to plunge, falling 66% during the quarter (Factset). The inter-dependency of financial flows touched virtually all financial assets and left a list of uncertainties over how to factor lost earnings, interest, dividend and other payments. As the curtailment on activities expanded through March, markets progressively priced in more dire scenarios.

More recently, however, the virus data has shown a few signs of improvement. Social distancing and activity restrictions appear to have helped “flatten the curve” and slow the rate of new infections and hospitalizations. So far there have been far fewer instances of medical resources being overrun than initially feared. Though the projections change constantly, the recent trend in the forecasts is showing some hope. While still far from being able to project an end to the contagion, the improvement now allows for considerations about restarting the economy. The effect of the lockdowns will almost certainly be recessionary for the U.S. and world at large and efforts need to be made to manage the impact. We believe balancing the needs of health must be in the context of the economic picture as a deep and persistent recession could itself have significant implications for millions of people.

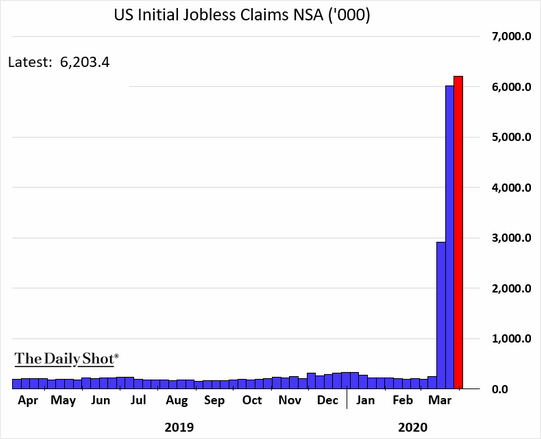

The challenge will be daunting. In just three weeks of reports covering the broad shelter-in-place actions, there have been almost 17 million new claims for unemployment in the U.S. Sadly, that number is probably underestimated as many states have had agency reporting systems overwhelmed with volume. The April monthly employment report will be released the first week of May and expectations are for the unemployment rate to be well into double digits. For perspective, the unemployment rate topped at 10% in the Great Financial Crisis of 2008 and saw an all-time high of 24.9% in 1933 (Statista). Depending on the length of home confinement, we believe this Depression-era level could be exceeded at some point this year for at least a short period. On the labor front, we are expecting news to get still worse before it turns the corner.

However, once it is believed the virus spread has been contained, the initial recovery from the unemployment depths should be substantial. Efforts to bridge business continuity and the need to re-staff many positions may initially be strong for some businesses. Transportation, manufacturing, and healthcare are among the areas we believe will more rapidly need to and be able to rehire. Still, getting back to the historically low levels of unemployment the economy enjoyed just a few months ago is probably a long way off. We expect many industries, particularly in travel, leisure, and entertainment to face numerous obstacles in rebuilding the volumes existent before this crisis. Many unknowns remain on the long-term structural changes to human interaction as a result of this pandemic.

Helping to bridge the economic gap are Federal fiscal and monetary support programs that are unrivaled to past economic rescues efforts in either size or speed of deployment. The already passed $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act has allocated relief funds for individuals, businesses and state and local governments. While disbursements have just begun from this program, additional legislation that could add another trillion or more is already being contemplated for passage later this month. The measures do not fill all the holes created by Coronavirus but are an initial attempt to offset some of the dislocations caused by the government shutdowns. How much more will be needed will depend on the duration of the closures. For perspective, total U.S. economic activity as measured by the Bureau of Economic Analysis (BEA) in 2019 was roughly $21.4 trillion, or about $1.8 trillion per month.

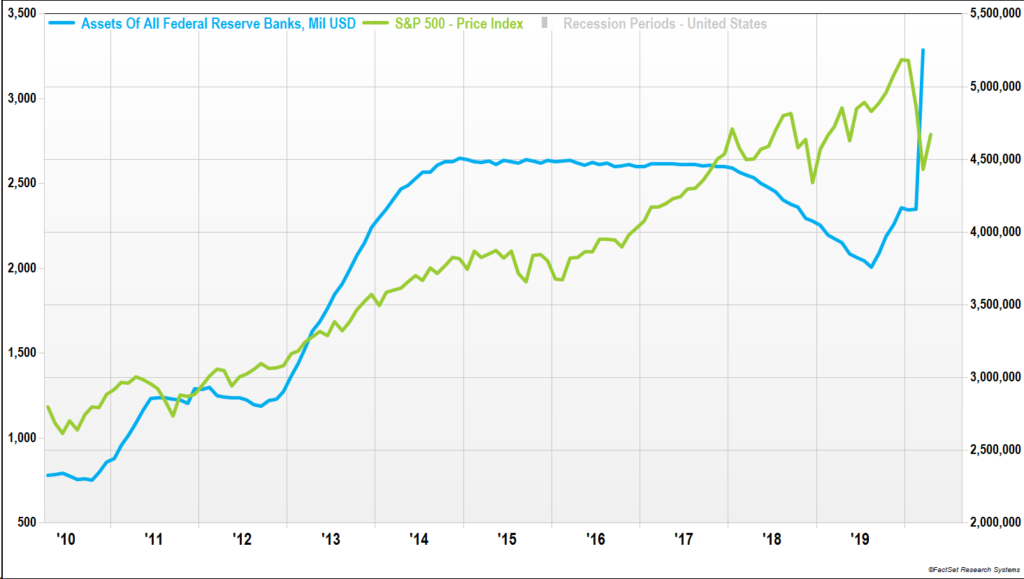

Overshadowing the fiscal efforts are monetary programs unleashed by the Federal Reserve in an effort to calm financial markets. The commitments are truly staggering in size and there are at least 10 programs to address different segments of the financial market. Some of these have been left open-ended on the amount of purchases the Fed is willing to make. Several of the efforts include markets new to Federal Reserve intervention. Bond ETFs, high yield and direct lending are just a few of the new areas the programs will support, generally through special purpose vehicles (SPVs) that work in partnership with the Treasury. The announcement of these efforts has already profoundly affected markets, particularly in corporate and municipal debt.

Fed facilities

- Money market lending facility

- Fed purchases of US Treasuries

- Commercial paper funding facility for municipals

- Fed purchases of mortgage back securities

- Term asset-backed securities loan facility

- Commercial paper funding facility for corporates

- Primary investment-grade credit funding facility (direct lending)

- Secondary corporate credit funding facility (asset purchases)

- Fed lending to Exchange Stabilization Fund (Main Street lending fund)

- Fallen Angel fund for bonds cut to non-investment grade after March 22.

- $25 billion fund for the purchase of bond ETFs

This is, of course, somewhat of a slippery slope. The intervention, essentially via printing money to buy securities, helps stabilize the price volatility but undermines the price discovery process that is a key feature of capitalism. Helping in the short-term, we believe these methods also risk hurting the long-term ability for the market to accurately price risk. We believe past intervention distorted the price of risk and has exacerbated the current weakness.

So far, one arena yet to see direct intervention by the Fed is the stock market. As part of the Fed mandate, they are not permitted to buy stocks, though given how quickly the landscape has changed it is difficult to say it couldn’t come to pass at some point. Several other countries – Japan, Switzerland, and Israel, among them – have central banks already buying stocks so the prospect doesn’t look far-fetched should conditions worsen.

Regardless of how the various support actions are judged by history, they are fast changing the economic world we occupy. Before the Coronavirus outbreak U.S. Treasury debt of about $24 trillion, annual deficits of around $1 trillion and a Fed balance sheet of $4 trillion were viewed as elevated and somewhat concerning by many, particularly given the ongoing economic expansion. Response to the crisis will result in a massive increase in each of these figures. In our opinion, it is not hard to see a deficit exceeding $4 trillion this year and the Fed balance sheet growing to $9 or $10 trillion. Deficits this year and next will likely push total U.S. indebtedness to $30 trillion or more by the end of next year. We believe the ballooning debt balances will weigh on the recovery growth potential and present significant challenges in managing tax and expenditure policies for years to come.

As of mid-April, financial markets have calmed significantly. We believe a flattening of the curve and aggressiveness of the financial support have both had big roles in walking the most significant fears back from the ledge. The monetary support, in particular, has addressed some of the liquidity issues that were contributing to the extreme moves in asset prices. However, the monetary and fiscal support can only go so far in affecting supply and demand constraints.

Rebuilding supply and demand will be dependent on when lockdowns are lifted and how society can come together again. Recently, we think the market may have overestimated how quickly or smoothly that process may evolve. Because life is unlikely to go back to the way it was pre-crisis, the process of opening a business and facilitating interactions is expected to happen slowly. We think that even businesses that can restart operations and hiring may do so more slowly as they evaluate how society and the economy will function in the new world order. We expect a lot less travel, few large gatherings and much more remote working and schooling to be the order of operations for some time to come.

Client allocations generally entered the first quarter more conservatively positioned than target due to concerns about tepid economic growth and risks stemming from the U.S. election. We did not, however, anticipate a global shutdown emanating from a Chinese pandemic. Because of the new risks that emerged to the long-term economic picture we did reduce risk further during the first quarter. Most of these actions focused on assets that were more tied to real estate and financial services. For real estate, we expect significant changes to occupancy needs and the ability to pay will weigh on cash flows and valuations for some time. In contrast, we view many companies in financial services as fundamentally strong, but now more challenged to make money in a world of near-zero or below interest rates. In Japan and Europe, they have had a lot of experience with negative rates and during that time banks and financial services companies have been poor investment performers.

Through this process we expect several new opportunities to emerge, though we believe patience will be warranted. Early winners of the crisis so far have included select drug companies, PPE suppliers and solutions like video conferencing. In our opinion, determining whether these are good long-term prospects requires evaluating the opportunities inclusive of what a post-response environment may look like and what the current valuation is relative to potential growth. For example, while many have been newly introduced to Zoom Video Communications (ZM), we view the current valuation at more than 50x sales as far from a sure thing for new investors. We believe there are still many unknowns to evolve as we deal with this pandemic and then as we turn the corner, the rebuilding process is likely to long and not without difficulty. As these developments unfold, we will continue to communicate any changes in our view and corresponding implications for client allocations.

Bradley Williams

Chief Investment Officer

Lowe Wealth Advisors

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lowe Wealth Advisors, LLC), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Lowe Wealth Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Lowe Wealth Advisors, LLC is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Lowe Wealth Advisors, LLC’s current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Lowe Wealth Advisors, LLC client, please remember to contact Lowe Wealth Advisors, LLC, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.